The LIC JEEVAN LAKSHYA (UIN: 512N297V02) is a participating individual non-linked life assurance savings plan offered by LIC.

LIC Jeevan Lakshya is an Individual Life that is Non-linked and Participatory.

Assurance package that provides both savings and protection.

The Annual Income Benefit offered by this plan may assist in meeting

the family’s requirements, especially those of the children, in the event that

of the regrettable policyholder’s passing at any point prior to maturity and a

lump sum payment upon maturity, regardless of whether the

Policyholder. With its loan, this plan also addresses the demand for liquidity.

A. Death Benefit:

Upon the life assured’s passing during the policy’s term, prior to the specified Maturity Date as long as the policy is in effect, that is, all Premiums that were due have been paid; death benefit is defined as the total of Simple Reversionary, endowed “Sum Assured on Death”

Bonuses and any applicable Final Additional Bonus will be paid out. where the definition of “Sum Assured on Death” is the greater of:

– Seven times the premium amount annually or the entire amount of 110% of the Basic Sum Assured, which is due on the maturity date and 10% of the annual income benefit of the Guaranteed Base Sum, which will be paid starting on the policy anniversary that falls on or after the date of the insured’s death and continuing until the policy anniversary that comes before the maturity date.

On the maturity date, the vested Simple Reversionary Bonuses and Final Additional Bonus, if any, included in the Death Benefit, will be paid.

The above-described Death Benefit cannot be lowered below 105% of the total premiums paid through the death date.

The prices shown above do not include taxes, additional premiums, or any applicable rider premiums.

B. LIC Jeevan Lakshya Maturity Benefit:

“Sum Assured on Maturity” plus vested Simple Reversionary bonuses and Final Additional bonus, if any, shall be payable on Life Assured surviving the policy period, provided the policy is in force. where Basic Sum Assured and “Sum Assured on Maturity” are the same.

C. LIC Jeevan Lakshya Profit Sharing:

As long as the policy is in effect, the policyholder will share in the Corporation’s profits and be eligible to receive Simple Reversionary Bonuses that are declared based on the Corporation’s experience. If someone passes away while a policy is in effect, the policy 3 will keep sharing in the income until the day of maturity as well as all vested Easy-to-Revert Bonuses and any last additional bonus will be paid on the due date. of adulthood. Accordingly, the Basic Reversionary Bonus and End Any further bonuses will be paid out in accordance with the policy on regardless of the Life Assured’s survival, the maturity date. If the premiums are not properly paid (except from in the event of death), of the Life Assured under the currently in effect policy), the policy expires. to share in future earnings regardless of whether or not the policy’s paid-up value has increased. Nevertheless, the policy will be deemed to be in effect during the grace period upon death.

Reduced paid-up policies will not apply to Final Additional Bonus payments.

Out of the excess that arises from the actuarial study, the actual distribution to policyholders shall be determined by the Central Government in compliance with the requirements of the LIC Act, 1956.

2. Qualifications and Additional Limitations:

The following are the minimum and maximum basic sums assured:

a)100,000, Mininmun Basic Sum Assured. respectively.

b) No Limits, of Maximum Sum Assured.

c) Duration of Policy: 13 to 25 years d) Duration of Premium Payment: (Duration of Policy – 3 Years)

e) Requires admittance to be at least 18 years old (latest birthday)

f) 50 years old is the maximum age at entrance (nearer birthday)

g) 65 is the maximum maturity age (nearer birthdate)

3. Choices accessible:

I. Benefits to Riders:

Under this plan, the next four optional riders are available for an extra fee. The policyholder, however, has the choice between the Accident Benefit Rider and the Accidental Death and Disability Benefit Rider offered by LIC. Thus, a policy may be used for a maximum of three riders.

(i) LIC’s Rider for Accidental Death and Disability Benefits (UIN:512B209V02) Under an active contract, this rider may be selected at any moment.

policy throughout the Base Plan’s premium-paying period given the exceptional premium-paying duration of the basic plan has a minimum of five years. Benefit coverage provided by this Rider will be accessible throughout the duration of the policy. If this cyclist is chosen in the event that an accidental death occurs, the Accident the Benefit Sum Assured will be paid all at once.

Future 4 premiums for Accident Benefit Sum Assured as well as premiums for the portion of Basic Sum Assured under the base policy that is equal to Accident Benefit Sum Assured shall be waived in the event of accidental disability arising from accident (within 180 days of the date of accident). In addition, an amount equal to the Accident Benefit Sum Assured will be paid in equal monthly instalments spread over 10 years in the event of an accident.

(ii) Accident Benefit Rider (UIN:512B203V03) offered by LIC

As long as the base plan’s outstanding premium payment term is at least five years, this rider may be selected at any point throughout the premium-paying period under an active policy. The duration of the premium-paying term is when the benefit coverage under this rider will be available.

In the event of an accidental death, the Accident Benefit Sum Assured will be paid out in full if this rider is selected.

(iii) New Term Assurance Rider (LIC, UIN: 512B210V01)

This rider is only accessible at the policy’s start. This rider’s benefit insurance will be available for use for the duration of the policy. If this rider is selected, upon the death of the life assured within the policy term, a sum equal to the Term Assurance Rider Sum Assured will be paid.

iv) (UIN: 512A212V01) The New Critical Illness Benefit Rider from LIC

This rider is only accessible at the policy’s start.

This rider’s coverage will be available for use for the duration of the insurance. In the event that this rider is selected, the Critical Illness Sum Assured will be due upon the initial diagnosis of any one of the 15 listed Critical Illnesses covered by this rider.

The rates under the base plan for LIC’s Accident Benefit Rider, Accidental Death and Disability Benefit Rider, and New Critical Illness Benefit Rider cannot exceed 100% of the base plan premium, and the rates under LIC’s New Term Assurance Rider cannot exceed 30% of the base plan premium.

The Basic Sum Assured under the Base plan cannot be exceeded by any of the aforementioned Rider Sum Assured.

See the rider brochure or get in touch with the closest LIC Branch Office for additional information on the aforementioned riders.

II. Choice to Receive Death Benefit in Parts:

In lieu of a lump sum payment, the corresponding lumpsum amount payable in the event of the life assured’s death may be received in instalments over the selected term of five, ten, or fifteen years. This amount is payable on the date of maturity under an active or paid-up policy. Only the Life Assured may use this option during their lifetime, for either the entire or a portion of the lump sum payment that is due in the event of their death as previously mentioned. The Net Claim Amount, or the amount chosen by the Life Assured, may be expressed as a percentage of the entire amount of claim profits payable or as an absolute sum.

The Annual Income Benefit that is due upon the death of the Life Assured will not be covered by this option.

The instalments must be paid in advance at quarterly, monthly, half-yearly, or annual intervals, depending on the method of payment selected. The minimum instalment amount for each mode of payment is as follows:

Payment method for instalments Minimum payment amount: Rs5,000 every month; Rs15,000 per quarter; Rs25,000 per half-year; Rs50,000 per year

The claim will only be paid in full if the Net Claim Amount is less than what is needed to cover the minimum instalment amount under the terms of the Life Assured’s option.

The interest rates that will be used to determine the instalment payments under this option will be determined periodically by the Corporation.

The Life Assured may exercise the option to collect Death Benefit in instalments at any time during their lifetime as long as the policy is in effect, providing the net claim amount and the duration of instalment payment. The nominee will then receive the death claim amount in accordance with the Life Assured’s exercised choice, and the nominee will not be permitted to make any changes.

III. Settlement Option (for Maturity Benefit):

Under an active and fully paid-up policy, Settlement Option allows the recipient to receive Maturity Benefit in instalments over a selected term of 5, 10, or 15 years as opposed to a lump sum payment. The Life Assured may take this option to receive all or a portion of the policy’s payable maturity proceeds. The Net Claim Amount, which is the amount selected by the Life Assured, may be expressed as a percentage of the entire amount of claim profits payable or as an absolute sum.

The instalments must be paid in advance at quarterly, monthly, half-yearly, or annual intervals, depending on the method of payment selected. The minimum instalment amount for each mode of payment is as follows:

Method of Payment via Instalments Minimum payment amount: Rs5,000 every month; Rs15,000 per quarter; Rs25,000 per half-year; Rs50,000 per year

The claim process will only be paid in lump sum if the Net Claim Amount is less than what is needed to give the minimum instalment amount according to the choice specified by the Life Assured.

The interest rates that will be used to determine the instalment payments under the Settlement Option will be determined periodically by the Corporation.

The Life Assured must exercise the option for payment of net claim amount in instalments at least three months before to the maturity claim due date in order to use the Settlement Option against Maturity Benefit.

The first payment will be made on the maturity day. After that, payments will be made every month, every three months, every six months, or every year from the maturity date, depending on the manner of instalment payment that the life insured has chosen.

Following the start of the instalment payments under the settlement option:

i) In the event that a life insured has used their settlement option wishes to revoke this choice in opposition to Maturity Benefit as well as settle the unpaid instalments, the same will be permitted upon receipt of the Life Assured’s written request. In this instance, the lump sum amount that is greater than the the following will be settled, and the policy will end.

• the discounted total of all upcoming instalments that are due; or

• (The initial sum for which the option to settle was exercised) less the total amount of instalments previously paid;

ii. The interest rate that will be used to discount the upcoming instalment payments will be determined periodically by the Corporation.

iii. In the event that the Life Assured exercises the Settlement Option and dies after the Date of Maturity, the nominee will continue to receive the outstanding instalments in accordance with the option that the Life Assured exercised, and the nominee will not be permitted to make any changes.

4. Premium Payment Options:

Throughout the policy’s premium-paying term, premiums may be paid annually, half-yearly, quarterly, or monthly (via NACH exclusively) or by salary deductions.

5. The Pardon Period

After the date of the first unpaid premium, there will be a grace period of 30 days for annual, half-yearly, or quarterly premium payments, and 15 days for monthly premium payments. The policy will be deemed to be in effect during this time, providing uninterrupted risk coverage in accordance with the policy’s conditions. The Policy lapses if the premium is not paid before the end of the grace period.

The grace period mentioned above will also apply to rider premiums, which must be paid in addition to the base insurance payment.

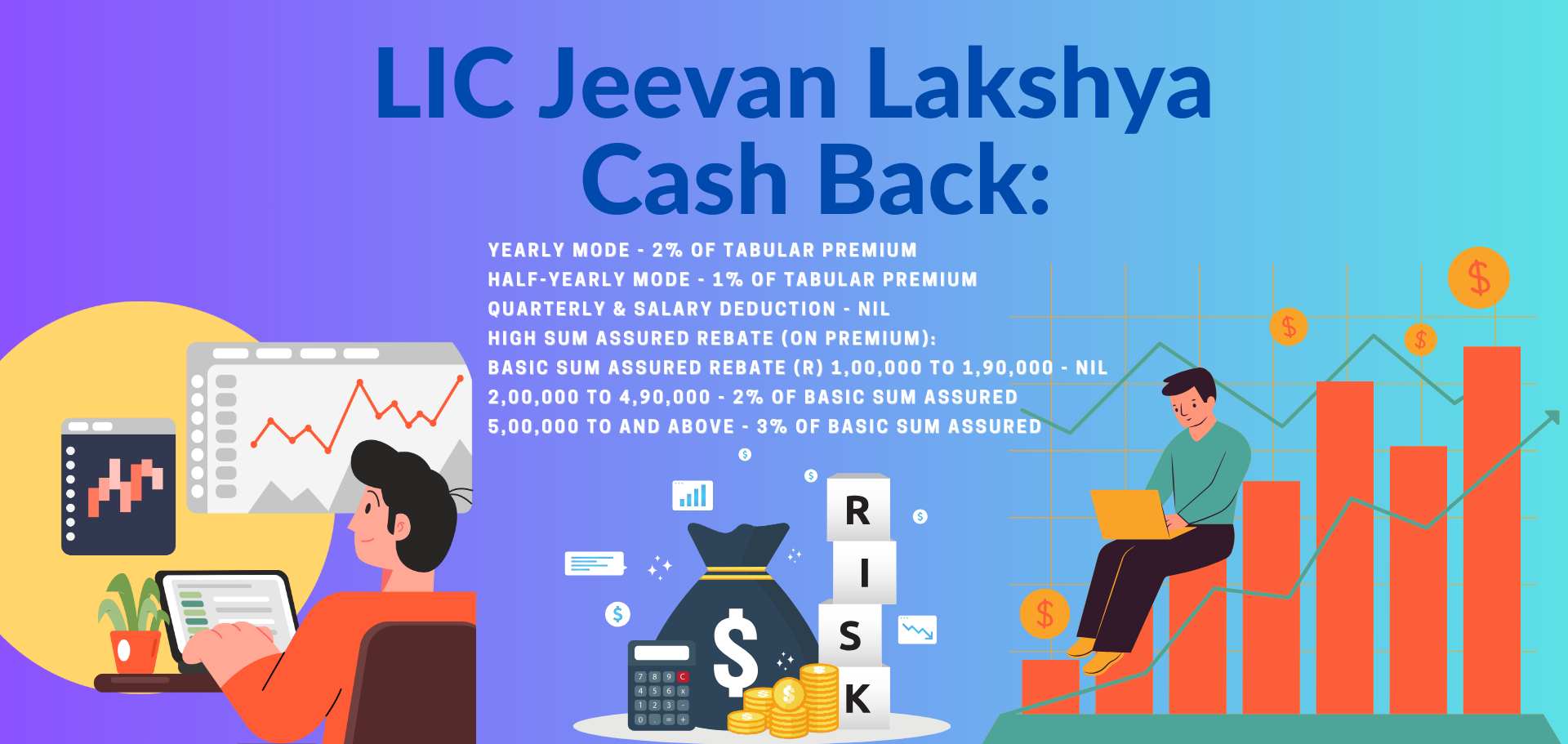

6. Cash Back:

Moderate Rebate: 2% of Tabular Premium in annual mode

Mode for half a year: 1% of the tabular premium

Salary and quarterly deductions: NIL

Guaranteed High Amount Rebate (on Premium):

Basic Ensuring Sum Return

1,00,000 – Nil to 1,90,000

Between Rs2,000 and Rs49,00,000, or 2% of the Basic Sum Assured

5,00,000 and above = 3% of the Basic Assured

7. Revival:

Should premiums be missed during the grace period, the policy will be shall expire. A coverage that has expired may be renewed in five years in a row starting on the date of the first unpaid premium and prior to the maturity date, if applicable. The comeback will be executed upon the full settlement of any premium arrears in addition to interest compounded every six months at a rate determined by the Corporation periodically, contingent upon the fulfilment of the life insured’s insurance ability based on information, records and reports that are currently on file, as well as any more data in this area that the policyholder or life insured provides if and when it becomes necessary in line with the Corporation’s underwriting policy at the time of revival.

A terminated policy may still be approved by the Corporation in its original form, with amendments, or not at all. A discontinued policy can only be revived if it is accepted, approved, and issued a revival receipt by the Corporation.

The reinstatement of the Base Policy will be taken into consideration in conjunction with the reinstatement of the rider(s), if chosen.

8. Paid-up Policy:

All benefits under the policy will end with the expiration of the grace period from the date of the first unpaid premium and nothing will be payable if less than two years’ worth of premiums have been paid and any future premiums are not duly paid.

The insurance will remain a paid-up policy until the end of the insurance Term even if all subsequent premiums are not paid on time once at least two full years of premiums have been paid.

Under a paid-up policy known as “Death Paid-up Sum Assured,” the benefit payable in the event of death will be the following:

• 110% of the Basic Sum Assured multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable, which will be paid on the date of maturity; and

• Reduced Income Benefit: from the policy anniversary that coincides with or follows the date of the life insured’s death until the policy anniversary prior to the date of maturity, 10% of the Basic Sum Assured multiplied by the ratio of the total period for which premiums have already been paid bears to the maximum period for which premiums were originally payable.

The amount known as the “Maturity Paid-up Sum Assured” will replace the Sum Assured on Maturity in paid-up policies. It is calculated by multiplying the Sum Assured on Maturity by the ratio of the total period for which premiums have already been paid to the maximum period for which premiums were originally payable.

A paid-up insurance will not be eligible to share in any earnings in the future.

The vested Simple Reversionary Bonuses, if any, will only be paid out on the policy’s maturity date and will be linked to the decreased paid up policy.

If the insurance is in lapsed status, the rider(s) do not receive any paid-up value, and the rider benefits are no longer applicable.

9. Surrender:

If the premiums for at least two complete years have been paid, the policy may be given up at any moment.The Surrender Value, which is the higher of the Guaranteed Surrender Value and the Special Surrender Value, will be paid by the Corporation upon policy surrender.

The Corporation will periodically examine and determine the Special Surrender Value, subject to IRDAI’s prior permission.

The entire premiums paid (apart from additional premiums, taxes, and premiums for riders, if selected) multiplied by the Guaranteed Surrender Value factors applicable to the total premiums paid, will be the Guaranteed Surrender value payable during the policy period.

10. Policy Loan:

Subject to the terms and restrictions that the Corporation may from time to time designate, As long as the premiums for at least two complete years have been paid, the policy may be used to secure a loan.

The following is the maximum loan amount, represented as a percentage of the surrender value:

• For laws currently in effect: 90%

• For fully paid policies: 80%

Periodically, the interest rate that will be applied to the policy loan and for the duration of the loan will be decided.

The Corporation’s declaration of the relevant interest rate, determined by the IRDAI-approved procedure, shall apply.

Any loan balance that remains after exit, whether by surrender or maturity, will be recouped through the claim procedures together with interest. However, in the event that the policyholder passes away, interest on the outstanding loan (principal amount plus interest) as of the policyholder’s death date will be recouped from any immediate benefits, such as Annual Income Benefits and Rider Benefits that are payable under the policy. The principal balance of the loan will be recouped from the final lump sum payment or, if applicable, any rider benefits under the policy.

11. Taxes:

The government imposes any applicable statute taxes on these insurance policies.

the Indian Tax Authority or any other Indian constitutional tax authority shall be as according to the tax regulations, and the tax rate will change periodically to the moment.

The policyholder will be responsible for paying all applicable taxes at the current rates on premiums (for the base insurance and any riders, if any), as well as any additional premiums that may be collected on top of the premiums that the policyholder is required to pay. The amount of benefits payable under the plan shall be computed without taking into account the amount of taxes paid.

Please consult a tax specialist for details on the advantages of income tax and how it affects the premiums paid and benefits payable under this plan.

12. Free Look period:

If the policyholder is unhappy with the “Terms and Conditions” of the policy, they may return the policy to the Corporation within 15 days of receiving the insurance bond outlining their objections. Upon receiving the same, the Corporation will cancel the policy and refund the premium deposit, less the proportionate risk premium (for the Base Plan and any applicable riders), any costs related to the medical examination, any special reports, and stamp duty charges, for the duration of the policy.

13. Exclusion: Suicide:

There will be no policy.

i. In the event that the Life Assured—whether sane or insane—kills themselves at

whenever within a year from the date of beginning risk, the Company will not consider any claim made in accordance with the policy, with the exception of the 80% total premiums paid, given the

Policy is operative.

ii. A sum equal to the greater of 80% of all premiums paid up until the date of death or the surrender value available as of the date of death will be paid out if the Life Assured—whether sane or insane—commits suicide within a year of the date of resurrection. Under the terms of the policy, the Corporation will not consider any further claims. This clause will not apply to plans that have lapsed without accruing paid-up value, and in such cases, there will be no reimbursement.

Note: The above-mentioned premiums do not include taxes, additional premiums, or any rider premiums—that is, if any—apart from the Term Assurance Rider.