LIC Jeevan Umang is a creative way to secure tax-free income for the rest of your life. The plan’s rising lifetime insurance coverage with age is another benefit. Due to its early surrender option and lack of surrender fees, the plan has significant liquidity.

The Jeevan Umang entire life insurance plan from LIC protects the insured up to age 100. The key advantage of this strategy is that it gives the policyholder’s family financial and insurance protection while they are away.

Which life insurance is the least expensive?

The cheapest LIC plan is the Jeevan Umang Policy. Only a 44 rupee premium each day is required, and upon maturity, you would receive 28 lakh rupees. This implies that you must make a monthly payment of 1302 rupees, or 15298 rupees annually.

Can I cancel the policy with LIC Jeevan Umang?

You can cancel your LIC Jeevan Umang coverage at any time if you have paid premiums on time for at least three years.

How is the premium for the Jeevan Umang policy determined?

[(Number of premiums paid / Total number of premiums due) x Sum Assured] is equivalent to the maturity amount. A paid-up policy will have its maturity sum promised lowered. The phrase “Maturity Paid-up Sum Assured” shall be used to refer to this amount, which is equal to [(Premium due / Total premiums paid) x Maturity Sum Assured].

Why is Jeevan Umang from LIC the best?

The Jeevan Umang plan from LIC provides risk protection to the end of the policy term. It offers exclusions on maturity returns under section 10D and income tax deductions for premiums paid toward the policy under section 80C.

What is the Jeevan Umang maturity amount?

You have a choice of 15, 20, 25, or 30 years to invest in this policy. You can amass a lump sum of 27 lakh rupees by setting aside just 45 rupees every day for your future. The Jeevan Umang policy provides you fantastic returns on investment.

What age requirement exists for LIC Jeevan Umang?

The minimum and maximum entry ages for the LIC Jeevan Umang Whole Life Insurance Policy are 90 days and 55 years, respectively. At the conclusion of the premium payment term, the policyholder’s age must be at least thirty.

What does Umang's entire name mean?

Umang’s official name is “Unified Mobile Application for New-age Governance.” In order to advance mobile governance in India, the National e-Governance Division (NeGD) and the Ministry of Electronics and Information Technology (MeitY) created the Umang app.

What does Umang's name mean?

Umang is a Sanskrit word that denotes eagerness, aspiration, and enthusiasm. It denotes a keen interest in and desire to engage in a project or activity.

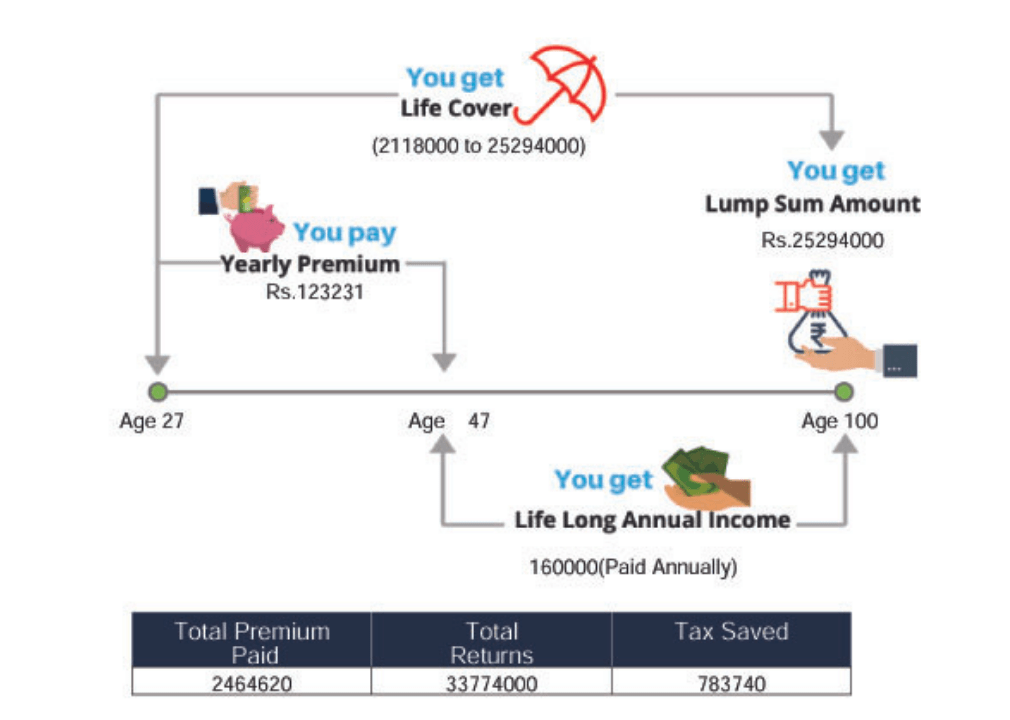

Here we discuss the plan Jeevan Umang’s. Mr Rohit Sharma is a Client, his birth date is (24/11/1996), Age – 27, Sum Assured : 2000000, Term : 73 years, Premium payment : 20 years. See this plane in below.

Jeevan Umang

( Plan No: 945)

Mr. Rohit Sharma

Age: 27 (24/11/1996)

Sum Assured : 2000000

Term : 73 years.

Premium payment : 20 years.

AD and DB Rider Cover : 2000000

Critical Illness Rider Cover : 2000000

Term Rider Cover : 2000000

The Jeevan Umang product from LIC is a ground-breaking way to guarantee tax-free income for the duration of your life. The life long insurance coverage of the plan grows with age, which is another benefit. As the plan can be abandoned earlier and incur no surrender fees, it offers significant liquidity.

The plan provides accident death and disability benefits of Rs. 20,000 and insurance coverage of Rs. 20,000. If an accident results in a permanent handicap, a monthly disability payment of Rs. 16667 will be provided until the end of the term or ten years, whichever comes first. There will also be a Rs. 2000000 Critical Illness Coverage option. A term rider with additional insurance coverage worth Rs. 2000000 has been introduced.

The plan also offers a tax benefit of Rs.39,187 per annum on the premium paid. The maturity/survival benefit shall be taxfree u/s 10(10D) of income tax act.

How the Plan works...

Mr. Rohit sharma pays an annual premium of Rs.123231 for 20 years.

Guaranteed, tax free survival benefit of Rs.160000 shall be paid up to age 100 after the period of 20 years.

Expected Maturity amount as per the current bonus rates comes to around Rs. 25294000.

Normal Insurance coverage and accidental insurance coverage is available during the term of the policy.

Loan and surrender facility is available after two years and at least two full-year premium payment.

Income tax rebate available on premium u/s 80C and the maturity/survival benefit shall be tax free under section 10(10D)

Benefit Pattern Illustration

Maturitiy Benefit

Benefits

Amount

Life long survival benefit (after 20 years)

1,60,000

Sum Assured

20,00,000

Bonus* (118000 X 20)+(58000 X 53)

54,34,000

Final Addition Bonus* (8930 per 1000 SA)

1,78,60,000

Expected Maturity Amount after 73 years.

2,52,94,000

Total Premium Paid

24,64,620

Tax benefit

Amount

Tax benefit on premium (@30 % Slab)

39187

Total tax benefit in 20 years.

783740

Nett premium paid

1680880

*Bonus rates shown as per the latest declared rates and differential bonus rates and final addition bonus rates as per the benefit illustration provided by the Corporation.

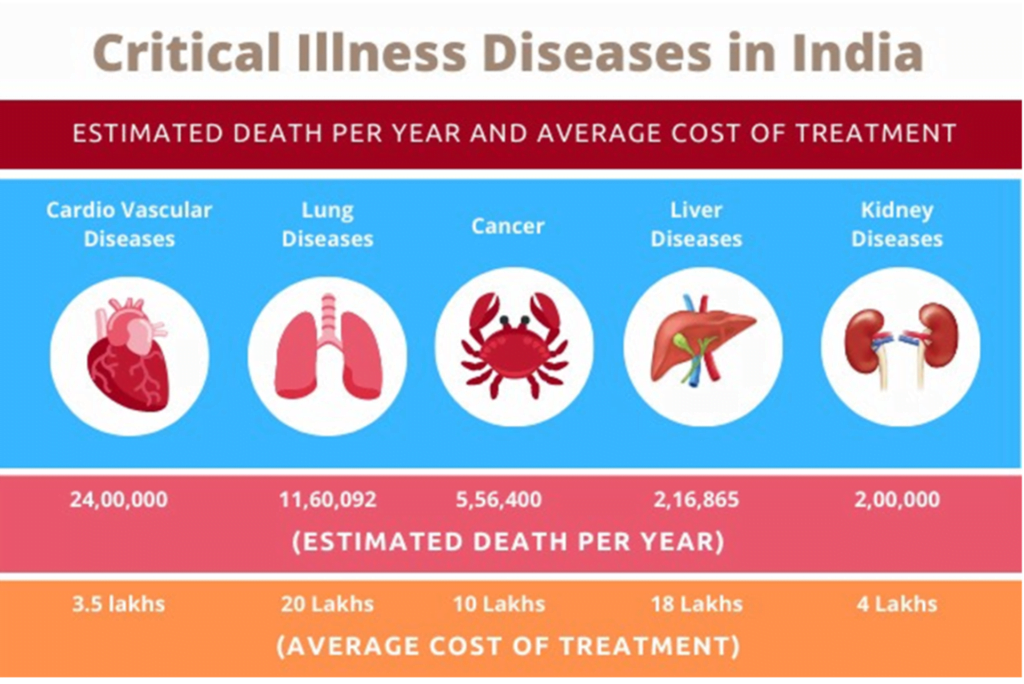

Critical Illness Rider-CIR

Premium Chart

First Year Premium

Subsequent Year Premiums

Mode

Basic Premium

GST @ 0.0%

Total Premium

Yearly

123231

0

123231

Half Yearly

62247

0

62247

Quarterly

31440

0

31440

Monthly

10480

0

10480

Mode

Basic Premium

GST @ 0.0%

Total Premium

Yearly

123231

0

123231

Half Yearly

62247

0

62247

Quarterly

31440

0

31440

Monthly

10480

0

10480

Critical Illness Rider-CIR

Critical Illness Rider Sum Assured:

1. Cancer of Specified Severity

2. Open Chest CABG

3. Myocardial Infraction

4. Kidney Failure (Requiring dialysis)

5. Major organ/Bone marrow transplant

6. Stroke with permanent symptoms

7. Permanent paralysis of limbs

8. Multiple sclerosis

2000000

9. Aortic Surgery

10. Alzheimer's Disease /Dementia

11. Blindness

12. Third degree burns

13. Heart valve repair /replacement

14. Benign Brain Tumor

15. Primary (Idiopathic) Pulmonary Hypertension

If any of the above mentioned diseases occurs during the coverage period a lump- sum amount equal to Rs. 2000000 will be paid

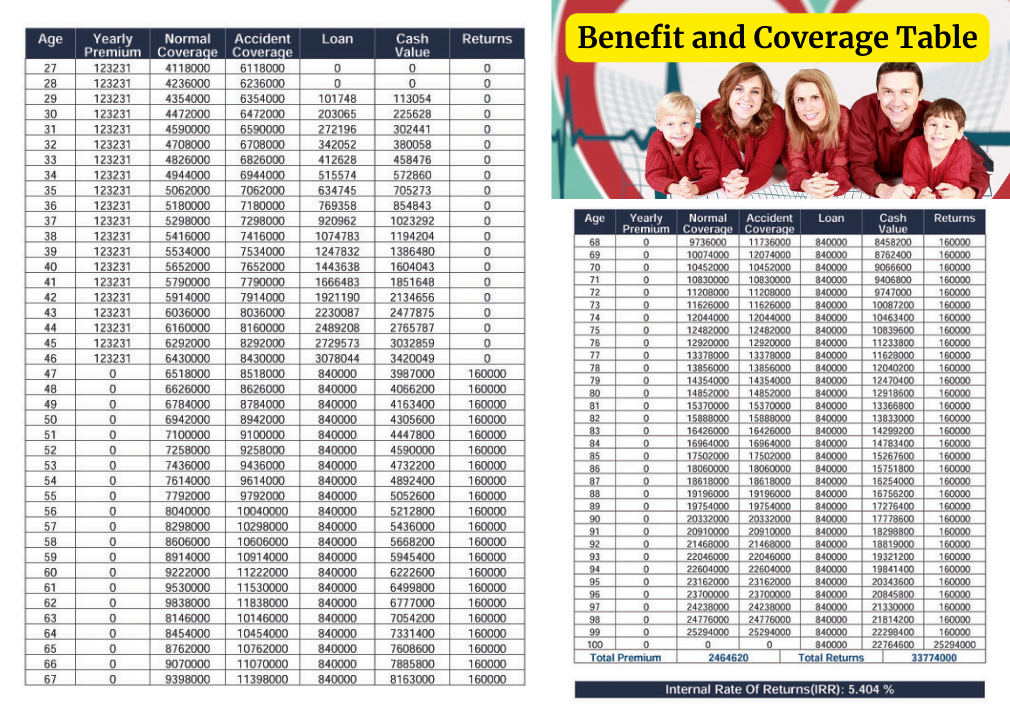

Benefit and Coverage Table

Conclusion

Here we discuss the plan Jeevan Umang. LIC Jeevan Umang Plan is a good plan for investor to invest their money in LIC.

Pingback: LIC New Endowment Plan : Plans, Features Bonus & Commission Details - LICMDRT

Pingback: LIC Money Back Policy: Want to Buy Money Back Plan, Plan Details & Features - LICMDRT