LIC Jeevan Labh (Plan No. 936) policy is one of the efficient life insurance policies provided by the Life Insurance Corporation of India. It is a limited premium-paying, non-linked, with-profits endowment plan that offers a range of benefits for the benefit of its clients and is not dependent on equity-based funds or the stock or money market.

Rider benefits include additional protection against severe illnesses, accidental death, and disability for an additional premium payment. The LIC’s Accidental Death and Disability Benefit Rider is one of the riders offered with LIC Jeevan Labh. Premium Waiver Benefit Rider for LIC.

LIC Jeevan Labh Death Benefit:

“Sum Assured on Death” combined with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, will be paid in the event that the Life Assured passes away before the designated Date of Maturity, assuming the policy is still in effect. Specifically, “Sum Assured on Death” is defined as the greater of Basic Sum Assured or seven times the Premium for each year.

If any additional premiums or riders were not paid, this death benefit must equal at least 105% of the total premiums paid.

LIC Jeevan Labh Maturity Benefit:

“Sum Assured on Maturity” along with vested Simple Reversionary Bonuses and Final Additional Bonus, if any, shall be payable on Life Assured surviving the stated Date of Maturity provided the policy is in-force. In this instance, “Sum Assured on Maturity” refers to the Basic Sum Assured.

Benefits of Riders:

This policy offers the following five riders:

A. Accidental Death and Disability Benefit Rider for LIC (UIN: 512B209V02)

B. New Term Assurance Rider for LIC (UIN 512B210V01)

C. Accident Benefit Rider from LIC (UIN: 512B203V03)

D. A New Rider for LIC’s Critical Illness Benefit (UIN 512A212V01)

E. Premium Waiver Benefit Rider for LIC (UIN: 512B204V03)

The eligible Life Assured can choose between the LIC’s Accidental Death and Disability Rider or the LIC’s Accidental Death and Disability Rider, however. Rider for accident benefits.

LIC Jeevan Labh Accident Benefit Rider/LIC's Accidental Death and Disability Benefit Rider:

Any of these riders may be chosen under an active policy at any time during the Base Policy’s Premium Paying Term if the Base Policy’s outstanding Premium Paying Term is at least five years. If a special request is made, this rider under the policy on the life of children will become accessible on the policy anniversary following the completion of the age of 18.

The LIC’s Premium Waiver Benefit Rider is available on the life of the policy proposer (as the life assured is a minor) at any time throughout the premium-paying period and coincident with the policy anniversary.

The Base Policy’s given term, which includes both the Base Policy’s and its rider, is at least five years.

Additionally, this rider is only permitted under policies when the life assured is a minor at the time this rider is chosen.

The duration of the rider is either the remaining premium-paying period of the base policy as of the date this rider was selected, or (25 minus the age of whichever is lesser (the minor Life Assured at the moment of choosing this rider).

If this rider is chosen, payment of Base Policy premiums that become due after the proposer’s death up until the end of the Rider Term will not be required. However, in this scenario, if the Base Policy’s Premium Paying Term any subsequent premiums owing under the Base Policy as of the day this Premium Waiver expires, regardless of whether the rider term is longer.

The Life Assured will be responsible for paying Benefit Rider Term. In the event that such a premium is not paid, the insurance would paid-up.

LIC's New Critical Illness Benefit Rider and Term Assurance Rider:

These riders can only be purchased at the the beginning of the policy on paying extra premiums.

Vesting of a policy on the life of a minor:

If the Life Assured is still alive on the Date of Vesting and if the Person Entitled to the Policy Moneys has not submitted a written request to the Corporation prior to the Date of Vesting, the Policy shall Automatically Vest in the Life Assured on the Date of Vesting.

Participation in earnings:

As long as the policy is in effect, it will, based on the Corporation’s experience, share in the profits of they must comply with the relevant terms of the LIC Act, 1956, as modified, and they must qualify for a Simple Reversionary Bonus at the rate and under the conditions that the Corporation may declare.

If the policy is in effect, simple reversionary bonuses must be disclosed yearly at the conclusion of each fiscal year.

Once disclosed, they become a part of the plan’s guaranteed benefit. The addition of Simple Reversionary Bonuses from the from the policy’s start date to the chosen policy term or, if earlier, until death.

Regardless of whether the insurance has accrued paid-up value, if the premiums are not paid on time, the policy will stop sharing in future earnings.

The Surrender Value of any vested bonuses, if any, as they applied on the day of surrender, shall be paid as per Condition 4 of Part D of this Policy Document in the event that the policy is surrendered.

In the year when the insurance generates a claim, whether through death or maturity, the last additional bonus may also be declared under the terms of the policy.

Under paid-up policies, Final Additional Bonus shall not be payable.

LIC Jeevan Labh Premium Payment:

(a.) The policyholder must pay the premium by the due dates listed in the Schedule of this policy document, along with any applicable taxes that may be required from time to time.

(b).If the Life Assured under an active policy dies after all premiums due up to the date of death have been paid, any balance premiums, if any, that become due after the date of death and before the next policy anniversary shall be deducted from the claim amount.

Customers are not required to be informed by the Corporation when a premium is due or how much is payable.

LIC Jeevan Labh Grace Period:

From the first unpaid premium date, monthly premiums have a grace period of 15 days and yearly, half-yearly, or quarterly premiums have a grace period of 30 days. The Policy expires if the premium is not paid before the days of grace have passed.

The insurance will remain in force, and benefits will be paid after deducting the aforementioned unpaid premium and any further premiums that become due after the death and before the next policy anniversary, if any. The policy will still be in effect if the Life Assured passes away during the grace period but before paying the premium that is then due.

Regulations on Forfeiture and Non-Forfeiture

Regulations on Forfeitures:

i. All benefits under this policy will end after the grace period expires from the date of the first unpaid premium and nothing will be payable. The premiums paid thus far are also not refundable if less than two years’ worth of premiums have been paid in relation to this policy.

ii. Forfeiture in Certain Other Events: In the event that any of the terms herein contained or endorsed hereon are violated, or if it is discovered that any information in the proposal, personal statement, declaration, and related documents is false or incorrect, or if any material information is withheld, this policy shall be void, and any claims to benefits arising from this policy shall be subject to the provisions of Section 45 of the Insurance.

Non-forfeiture Regulations:

If any premiums are not paid on time after at least two full years’ worth of premiums have been paid, this policy will not be completely void and will continue to be in effect as a paid-up policy until the conclusion of the policy term.

The “Death Paid-Up Sum Assured,” which is equal to the Sum Assured on Death multiplied by the proportion of the total period for which premiums have already been paid to the maximum period for which premiums were originally payable, shall be deducted from the Sum Assured on Death under a paid-up policy. The vested Simple Reversionary Bonus, if any, as well as the Death Paid-Up Sum Assured, shall likewise be payable on death.

The “Maturity Paid-Up Sum Assured,” which is equal to the Sum Assured on Maturity multiplied by the proportion of the total period for which premiums have already been paid to the maximum period for which premiums were originally payable, shall be deducted from the Sum Assured on Maturity under a paid-up policy. The vested Simple Reversionary Bonus, if any, as well as the Maturity Paid-Up Sum Assured, shall also be due on maturity.

Future profits are not eligible to be shared by a paid-up policy. The vested Simple Reversionary bonuses, if any, will still be linked to the policy’s lower paid-up amount.

Despite what was previously mentioned, if at least three full years’ worth of premiums have been paid for this policy and any subsequent premium is not properly paid, in the event that the Life Assured passes away within six months of the due date of the premium,

Last additional premium, “Sum Assured on Death” and vested simple reversionary incentives.

Bonuses, if any, shall be given after deducting (a) any unpaid basic policy premiums and interest on those amounts up to the date of death, under the same conditions as for the Policy’s resurrection during that time, and (b) the remaining premium(s) for the basic policy due prior to the following policy anniversary and as at the date of death. In the event of a suicide death, this regulation shall not apply.

Despite what was previously stated, if at least 5 full years’ worth of premiums have been paid for this policy and any subsequent premium is not paid in a timely manner, “Sum Assured on Death” will be paid after deducting (a) any unpaid premiums for the base policy and interest accrued up until the date of death (plus any vested Simple Reversionary Bonuses and Final Additional Bonus, if any) the outstanding premium(s) for the base policy becomes due from the date of death and before the next policy anniversary. under the same conditions as for revival of the Policy during such period. In the event of a suicide death, this regulation shall not apply.

Riders are exempt from all of the aforementioned non-forfeiture regulations because they do not gain any paid-up value.

If the policy is in expired state, the riders advantage no longer applies.

Reviving expired policies:

If the required premium is not paid by the due date during the grace period, the insurance policy will lapse. During the life of the life assured, a lapsed policy may be restored, but only during the revival period and prior the Date of Maturity, if applicable. The revival will take effect once all outstanding premium(s) have been paid in full. with interest (compounding every half year) at the rate that the Corporation may from time to time determine, and upon satisfaction of the Life Assured’s and/or the Proposer’s Continued Insurability (On the basis of information, documents, and reports that are already available, as well as any additional information in this regard that may be needed in accordance with the Corporation’s underwriting policy at the time of revival, being provided by the Policyholder/Life Assured/Proposer (if LIC’s Premium Waiver Benefit Rider is selected).

However, the Corporation retains the right to accept the revival of a discontinued policy with its original terms, accept it with amended terms, or deny it. Only until the Corporation has approved, accepted, and issued a revival receipt for the discontinued insurance will it become effective.

If chosen, the revival of the Rider(s) will only be taken into account in conjunction with the resurrection of the Base Policy and not separately.

LIC Jeevan Labh Surrender :

Surrender If two full years’ worth of premiums have been paid, the policyholder may surrender the policy at any time throughout the policy term. When a policy is surrendered, the corporation must pay the higher of the guaranteed surrender value or the special surrender value as the surrender value.

The Special Surrender Value is subject to revision at any moment and shall be decided by the Corporation with IRDAI’s prior permission.

The total premiums paid (minus any extra premiums, any premiums for rider(s), if selected, and taxes) multiplied by the Guaranteed Surrender Value factor applicable to the total premiums paid will equal the Guaranteed Surrender Value payable over the policy period. These Guaranteed Surrender Value variables, which are presented as percentages in Annexure 4 of this Policy Document, are dependent on the policy term and policy year in which the policy is surrendered.

The surrender value of any vested simple reversionary bonuses, if any, is likewise payable and is calculated by multiplying the vested bonuses by the guaranteed surrender value factor that applies to vested bonuses. These Guaranteed Surrender Value variables, which are listed in Annexure – 5 of this Policy Document, will vary depending on the policy term and the policy year in which the policy is surrendered.

If there are any riders, there will be no surrender value offered.

LIC Jeevan Labh Loan Facility:

Loans made under policies are subject to the following terms and conditions, within the policy’s surrender value, and are available for the following amounts and under any additional terms and conditions that the corporation may impose from time to time:

i.If at least two complete years’ worth of premiums have been paid, a loan may be requested.

ii. The maximum loan amount that may be provided is as follows:

a. For policies already in effect, surrender values may be up to 90%.

b. Up to 80% of Surrender Value for paid-up policies

iii. The Proposer may use the loan while the Life Assured is still a minor as long as it is obtained for the benefit of the Life Assured while still a minor.

iv. As security for the repayment of the Loan and of the interest thereon, the Policy shall be irrevocably transferred to and retained by the Corporation.

v. Interest on the Loan shall be paid to the Corporation on a compounding half-yearly basis at a rate to be determined by the Corporation at the time a Loan is taken under this Policy. The IRDAI-approved methodology shall serve as the foundation for the appropriate interest rate. The first interest payment is due on the next policy anniversary or six months before the following policy anniversary, whichever comes first and is immediately after the date the loan is approved. Thereafter, interest payments are due every six months.

vi. The Corporation would have the right to foreclose on such policies in the event that loan interest was not paid on the due dates as stated above and when the balance of the loan plus interest exceeded the surrender value. When such policies are foreclosed, the difference between the surrender value and the loan balance, as well as any applicable interest, must be paid.

vii. The Corporation shall be entitled to deduct the amount of the Loan or any portion thereof that is outstanding, along with all interest, from the proceeds of the policy in the event that it matures, is surrendered, or becomes a claim due to death.

viii. With a three-month notice, the Corporation may collect or recall the full amount of the loan, including all accrued interest.

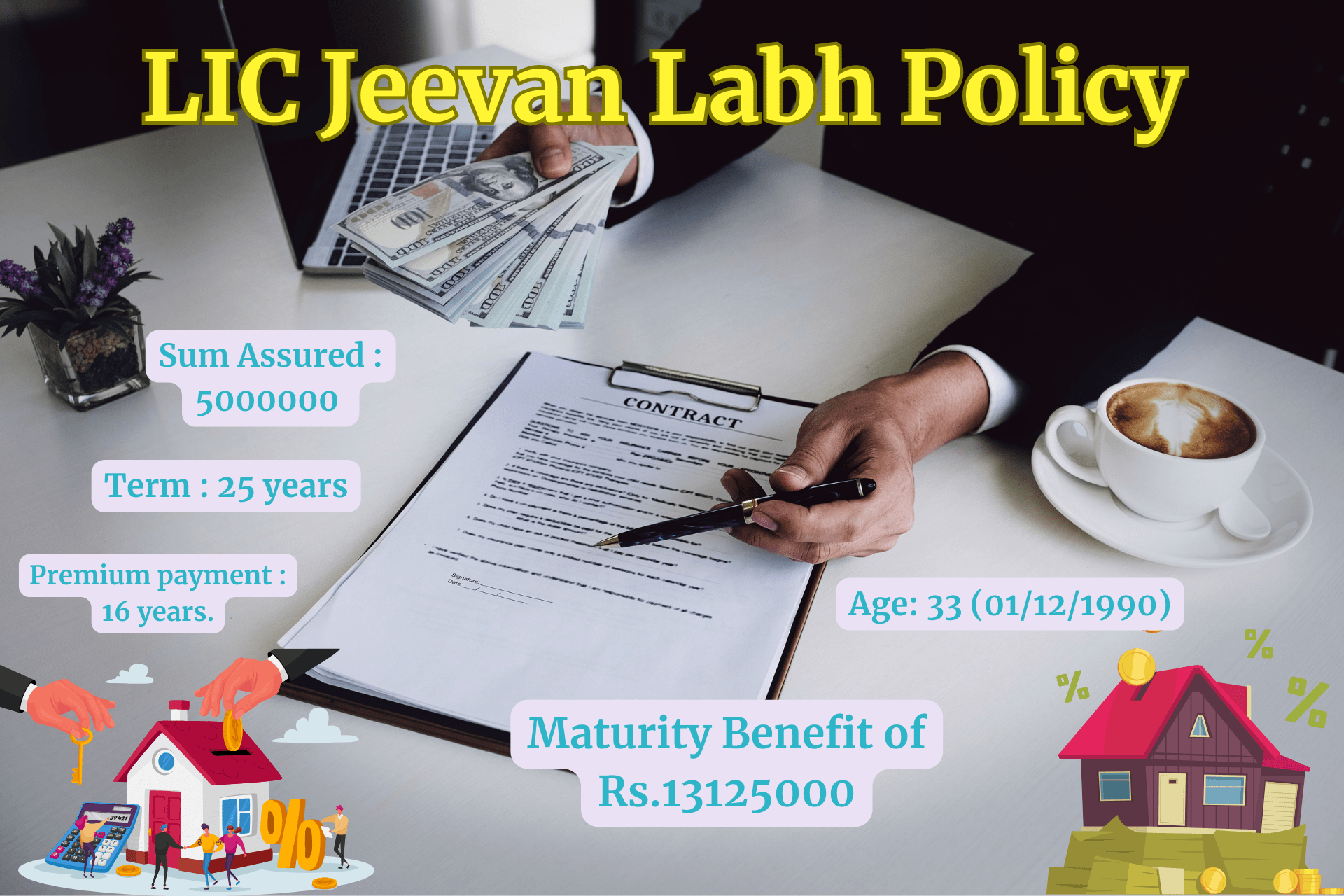

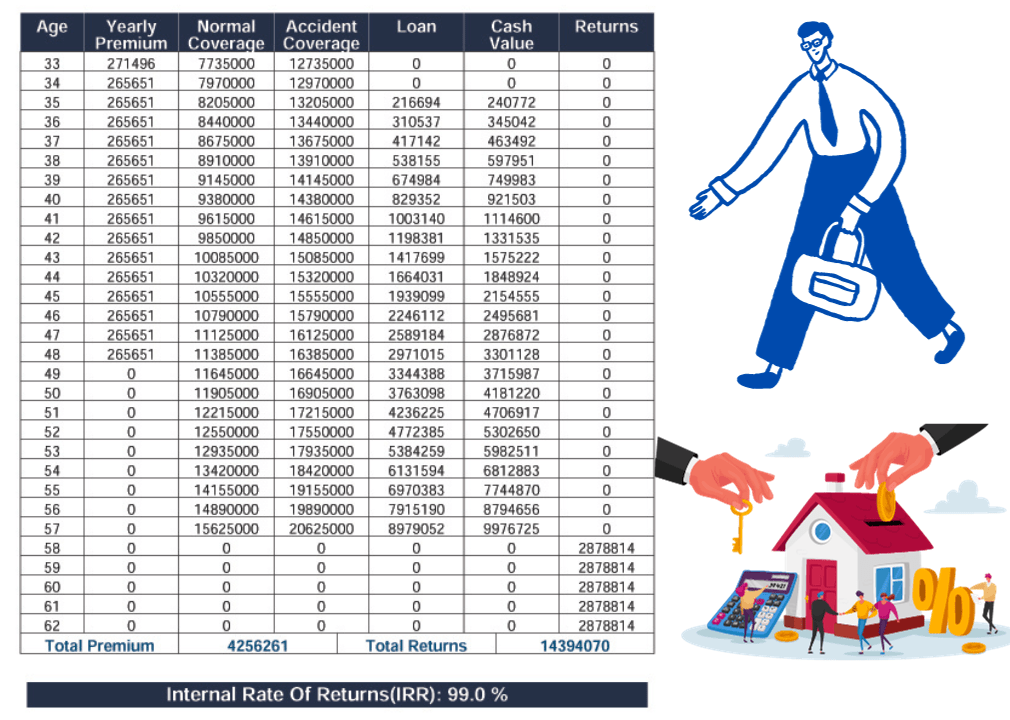

Here we discuss the plan LIC Jeevan Labh (Plan No : 936) Mr Virat Kohli is a Client, his birth date is (01/12/1990), Age – 33, Sum Assured : 5000000, Term : 25 years, Premium payment : 16 years. See this plane in below.

LIC Jeevan Labh Plan

Mr. Virat kohli

Age: 33 (01/12/1990)

Sum Assured : 5000000

Term : 25 years

Premium payment : 16 years.

AD and DB Rider Cover : 5000000

Critical Illness Rider Cover : 2500000

Term Rider Cover : 2500000

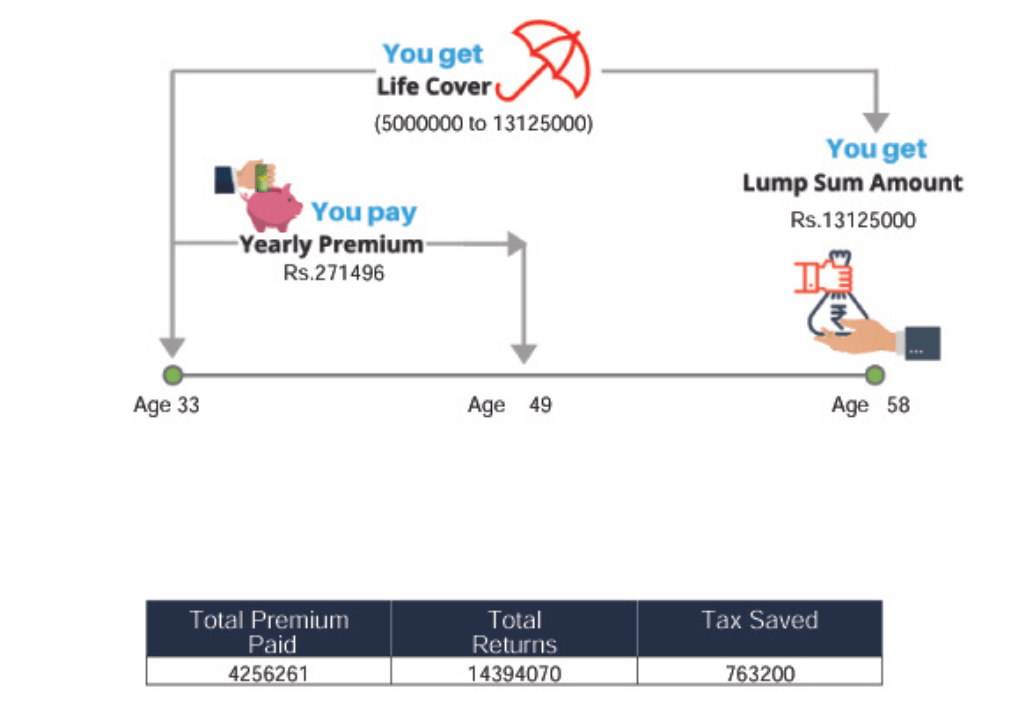

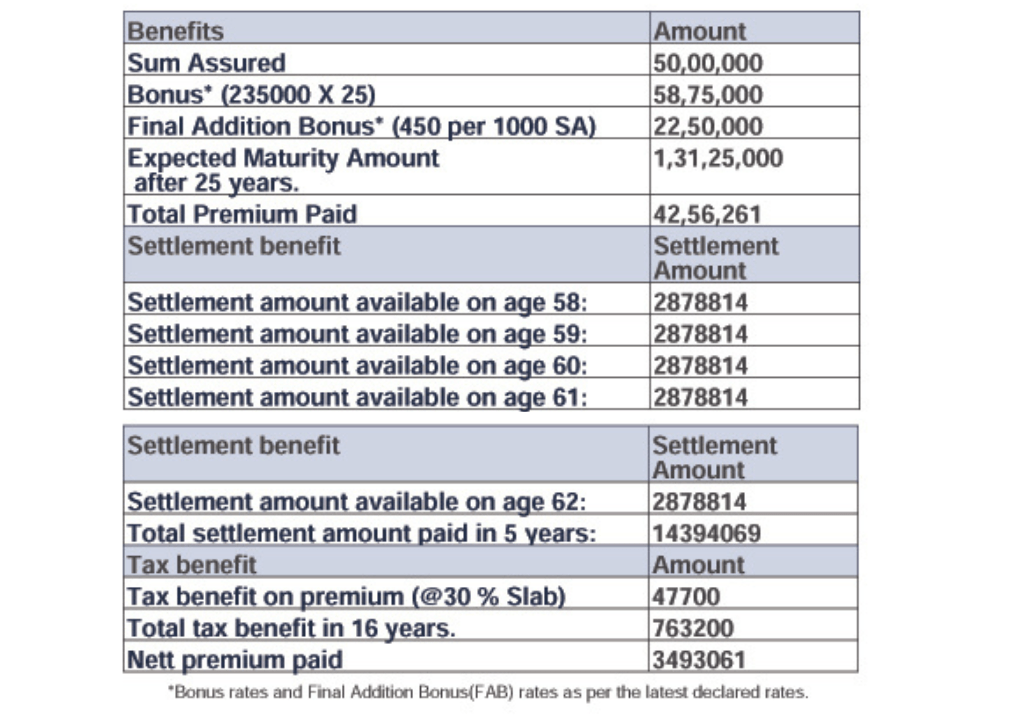

The Jeevan Labh limited payment plan from LIC is, as its name implies, a low premium, high maturity benefit plan. This strategy is ideal for anyone looking to establish a future corpus money to accommodate varied needs. This 25-year strategy can give you a maturity benefit of Rs. 13125000 is received after just paying Rs. 4256261 over 16 years.

The plan provides Rs. 50,000 in insurance coverage, as well as Rs. 50,000 in accident death and disability benefits. If an accident results in a permanent handicap, a disability payment of Rs. 41667 will be paid each month until the end of the term or ten years, whichever comes first. There will also be a Rs. 2500000 Critical Illness Coverage option. A term rider with additional insurance coverage worth Rs. 2500000 has been introduced.

Additionally, the plan provides an annual tax credit of Rs. 47,700 on the premiums paid. According to Section 10(10D) of the Income Tax Act, the maturity/survival benefit is tax-free.

How the plan works...

Mr. Virat kohli pays an annual premium of Rs.265651 for 16 years.

Maturity amount (SA+Bonus+FAB) is paid after the policy term of 25 years.

Expected Maturity amount as per the current bonus rates comes to around Rs. 13125000.

Normal Insurance coverage and accidental insurance coverage is available during the term of the policy.

Loan and surrender facility is available after two years and at least two full-year premium payment.

Income tax rebate available on premium u/s 80C and the maturity/survival benefit shall be tax free under section 10(10D)

Benefit Pattern Illustration

Maturitiy Benefit

Premium Chart

First Year Premium

Subsequent Year Premiums

Mode

Basic Premium

GST @ 4.5%

Total Premium

Yearly

259805

11691

271496

Half Yearly

131201

5904

137105

Quarterly

66250

2981

69231

Monthly

22084

994

23078

Mode

Basic Premium

GST @ 4.5%

Total Premium

Yearly

259805

5846

265651

Half Yearly

131201

2952

134153

Quarterly

66250

1491

67741

Monthly

22084

497

22581

Benefit and Coverage Table

Conclusion

Here we discuss the details the LIC Jeevan Labh Plan (Plan No : 936) . LIC Jeevan Labh Plan is a good plan for investor to invest their money in LIC.

Pingback: LIC Dhan Vriddhi Policy : Ish Laxmi Puja Main Dhan Biddhi Mantra, - LICMDRT

Pingback: LIC Money Back Policy: Want to Buy Money Back Plan, Plan Details & Features - LICMDRT