The LIC New Endowment Plan from LIC is a specialized package insurance plan designed to cover future financial needs regardless of life’s challenges.

This arrangement provides the family of the deceased policyholder with financial assistance at any time before to maturity as well as a good lump sum payment for the surviving policyholders at maturity. Through its credit facility, this plan also addresses the issue of liquidity.

What new LIC policy will be implemented in 2023?

Sales of the LIC Dhan Vriddhi plan will take place between June 23, 2023, and September 30, 2023. There are no future premium obligations or lapsations because it is a single premium plan.

What advantages does the LIC new endowment plan offer?

LIC The new endowment plan offers benefits for maturing and dying. During the term of the policy, the combination of saving cum protection offers the family of the deceased insurance holder a financial cushion.

Is the LIC endowment plan effective?

LIC’s endowment plans also come with some further advantages. For instance, while some plans produce savings through investments in the equity markets, others benefit from company profits.

LIC endowment plans are they taxable?

In conclusion, the LIC maturity amount is totally exempt from taxes under Section 10(10D) unless the premium exceeds 10% of the sum insured (20% for plans issued after April 1, 2003).

What does an endowment policy's maturity benefit entail?

If the policyholder dies within the policy term, the nominee is entitled to the death benefit or the sum assured under an endowment policy. The maturity benefit, which consists of the sum assured plus any bonuses earned throughout the policy term, is given to the policyholder if they live over the policy term.

What is the maturity advantage of a LIC New endowment plan?

Benefit upon Maturity of LIC Endowment Plan

The policyholder will receive a sum guaranteed by the insurer upon maturity, which includes vested reversionary bonuses and further bonuses, if any, upon surviving the official policy tenure. This Maturity Sum Assured is the same as the LIC New Endowment Plan’s Basic Sum Assured.

What drawbacks do endowment funds have?

Disadvantages. High costs incurred by these policies: Generally speaking, endowments charge larger fees than other types of investment vehicles, such unit trusts or mutual funds. These costs may reduce investment returns, which would lower the policy’s overall profitability.

Which two sorts of endowment plans are there?

The five types of endowment plan life insurance plans that are available are listed below for people to evaluate depending on their financial situation.

- Unit Linked Endowment Plans,

- Guaranteed Endowment Plans

- Full/With Profit Endowment Plans,

- Low-Cost Endowment Plans, and

- Non-Profit Endowment Plans are only a few options.

Is an endowment plan dangerous?

Endowment plans have the advantage of offering low to moderate risk. Because endowment plans don’t engage in direct investing in equity funds or stock markets like mutual funds, your savings plan becomes less hazardous. They are therefore immune to market dangers.

Are endowment plan returns guaranteed?

A life insurance policy that offers life coverage* and promotes financial growth is known as an endowment plan. It offers returns that are predetermined at the time the insurance is purchased.

Can I cancel my endowment policy with LIC?

After three years have gone, the policyholder may only cancel their coverage within the guaranteed surrender value. This indicates that the premium cannot be paid until at least three years have passed. After three years, you can surrender for about 30% of the premiums you’ve already paid.

At age 65, what is the endowment?

When discussing life insurance policies, endowment and maturity essentially imply the same thing. It is the moment when the beneficiary or the policyowner in an endowment policy receives the policy’s benefits. An endowment policy establishes a deadline for the insurance’s maturity (often at or beyond age 65).

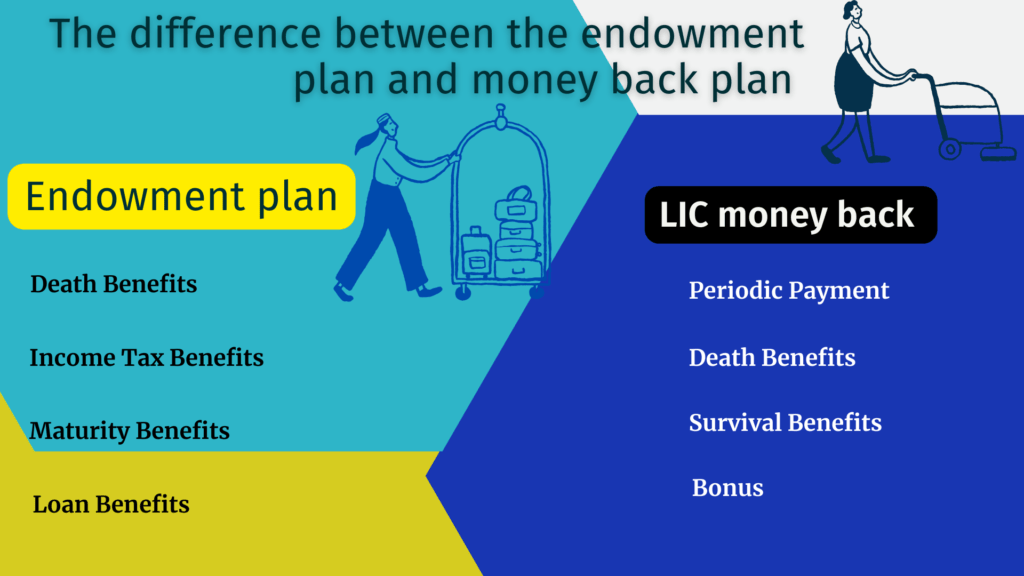

What distinguishes an endowment plan from a LIC money-back policy?

The endowment plan and the money-back plan vary in that, upon maturation, the endowment plan pays out both the sum assured and the bonus. In contrast, a money-back plan pays the policyholder a certain proportion of the sum insured on a regular basis.

What are the LIC endowment plan's tax advantages?

This advantage allows the insured individual to deduct life insurance premiums up to Rs. 1,50,000 from their taxable income in accordance with Income Tax Act Section 80(C). In accordance with Section 10(D) of the Income Tax Act, the maturity benefit is likewise tax-free provided that all requirements are met.

Good or bad LIC endowment policy?

The programs have a long-term investment outlook. The death benefit is given if the insured passes away while the policy is in effect. However, a maturity benefit is paid if the insured lives until the conclusion of the insurance term. Endowment plans so assist policyholders in setting aside money for their financial objectives.

What is the maturity advantage of a LIC New endowment plan?

Benefit upon Maturity of LIC New Endowment Plan

The policyholder will receive a sum guaranteed by the insurer upon maturity, which includes vested reversionary bonuses and further bonuses, if any, upon surviving the official policy tenure. This Maturity Sum Assured is the same as the LIC Endowment Plan’s Basic Sum Assured.

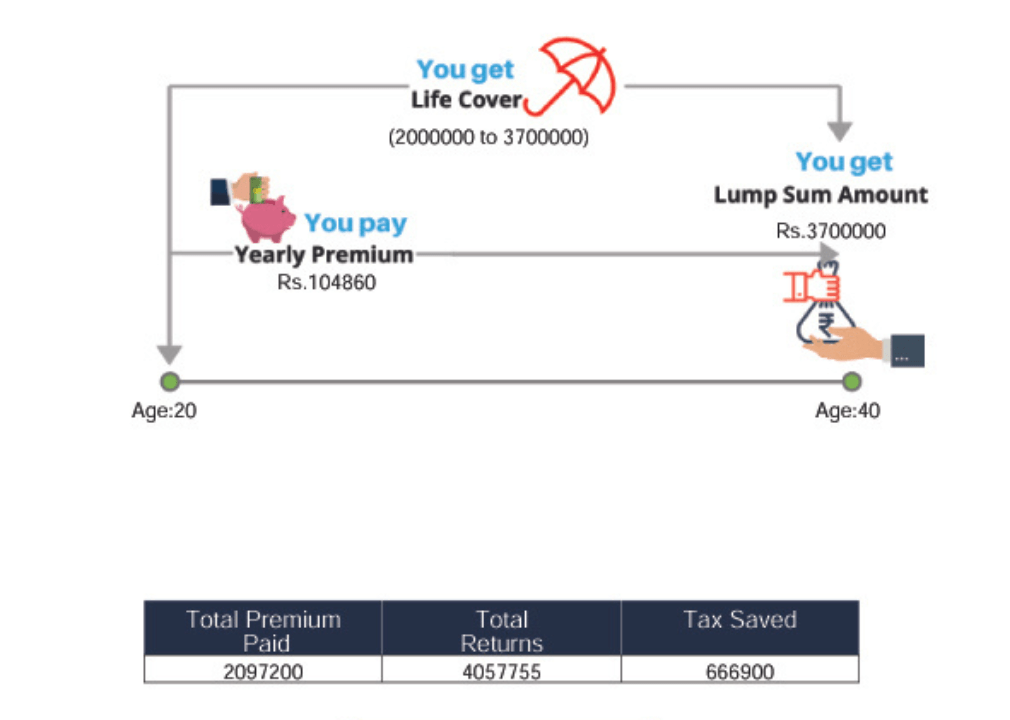

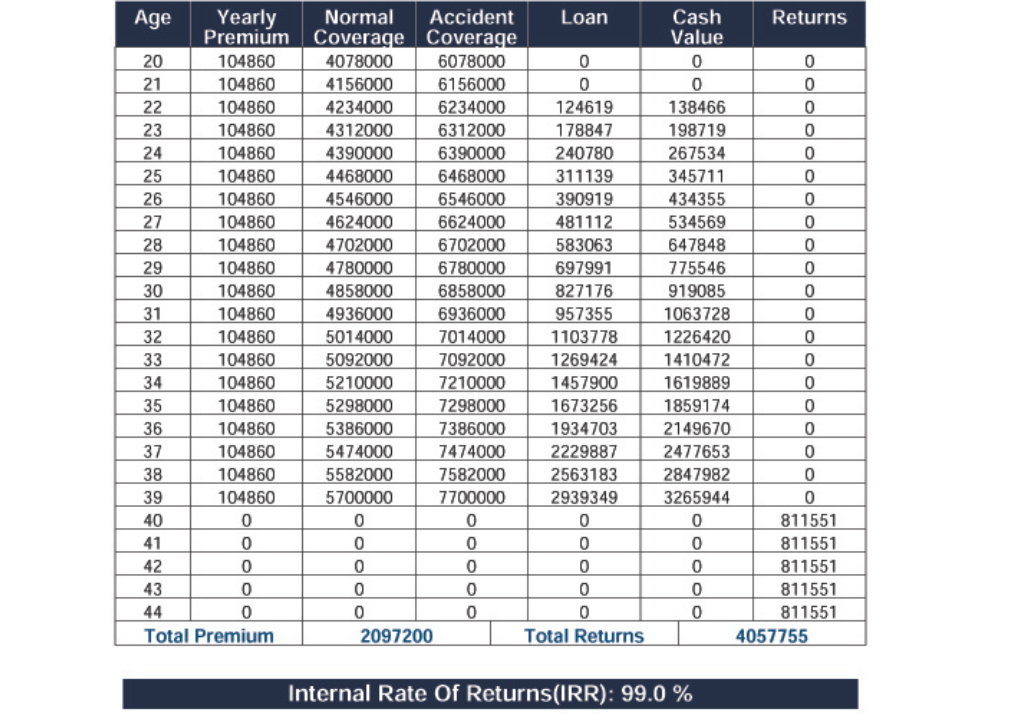

Here we discuss the plan LIC New Endowment Plan (Plan No : 914) Mrs Sweta Singh is a Client, her birth date is (12/06/2003), Age – 20, Sum Assured : 2000000, Term : 20 years, Premium payment : 20 years. See this plane in below.

New Endowment Plan ( Plan No: 914)

Mrs. Sweta Singh

Age: 20 (12/06/2003)

Age: 20 (12/06/2003)

Sum Assured : 2000000

Term : 20 years.

Premium payment : 20 years.

AD and DB Rider Cover : 2000000

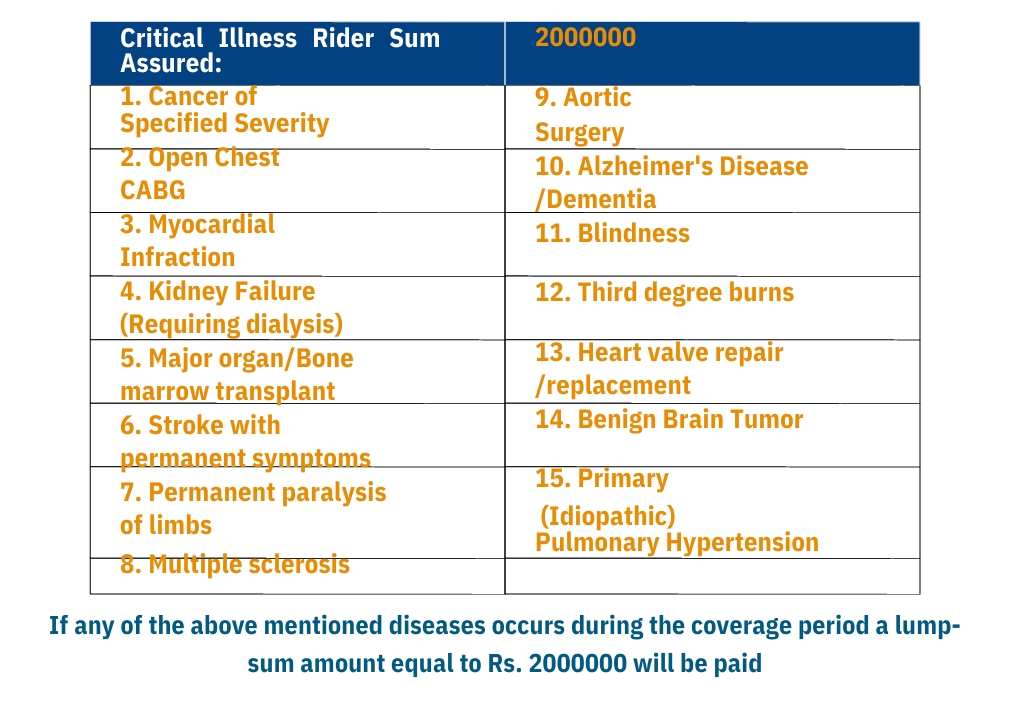

Critical Illness Rider Cover : 2000000

Term Rider Cover : 2000000

The purpose of LIC’s New Endowment Plan is to provide a customized insurance solution that can cover future expenses regardless of life’s uncertainties.

The plan provides Rs. 20,000 000 in insurance coverage as well as Rs. 20,000 000 in accident, death, and disability benefits. Disability payment of Rs. 16667 per month, till the end of the term or ten years (whichever is earlier), must be paid in the event of a permanent disability resulting from an accident. There will also be a Rs. 2000000 Critical Illness Coverage accessible. A term rider with additional insurance coverage worth Rs. 2000000 has been introduced.

In addition, the plan provides a tax credit of Rs. 33,345 on the premium paid annually. The income tax act’s Section 10(10D) states that the maturity/survival benefit is tax-free.

How the Plan Works....

Mrs Sweta Singh pays an annual premium of Rs 104860 for 20 years.

Maturity amount (SA+Bonus+FAB) is paid at the end of the policy term of20 years

Expected Maturity amount as per the current bonus rates comes to around Rs. 3700000.

Normal Insurance coverage and accidental insurance coverage is available during the term of the policy.

Loan and surrender facility is available after two years and at least two full-year premium payment.

Income tax rebate available on premium u/s 80C and the maturity/survival benefit shall be tax free under section 10(10D)

Benefits Pattern Illustration

Maturitiy Benefit

Benefits

Amount

Sum Assured

20,00,000

Bonus* (78000 X 20)

15,60,000

Final Addition Bonus* (70 per 1000 SA)

1,40,000

Expected Maturity Amount after 20 years.

37,00,000

Total Premium Paid

20,97,200

Settlement benefit

Settlement Amount

Settlement amount available on age 40:

811551

Settlement amount available on age 41:

811551

Settlement amount available on age 42:

811551

Settlement amount available on age 43:

811551

Settlement amount available on age 44:

811551

Total settlement amount paid in 5 years:

4057757

Tax benefit

Amount

Tax benefit on premium (@30 % Slab)

33345

Total tax benefit in 20 years.

666900

Nett premium paid

1430300

*Bonus rates and Final Addition Bonus(FAB) rates as per the latest declared rates.

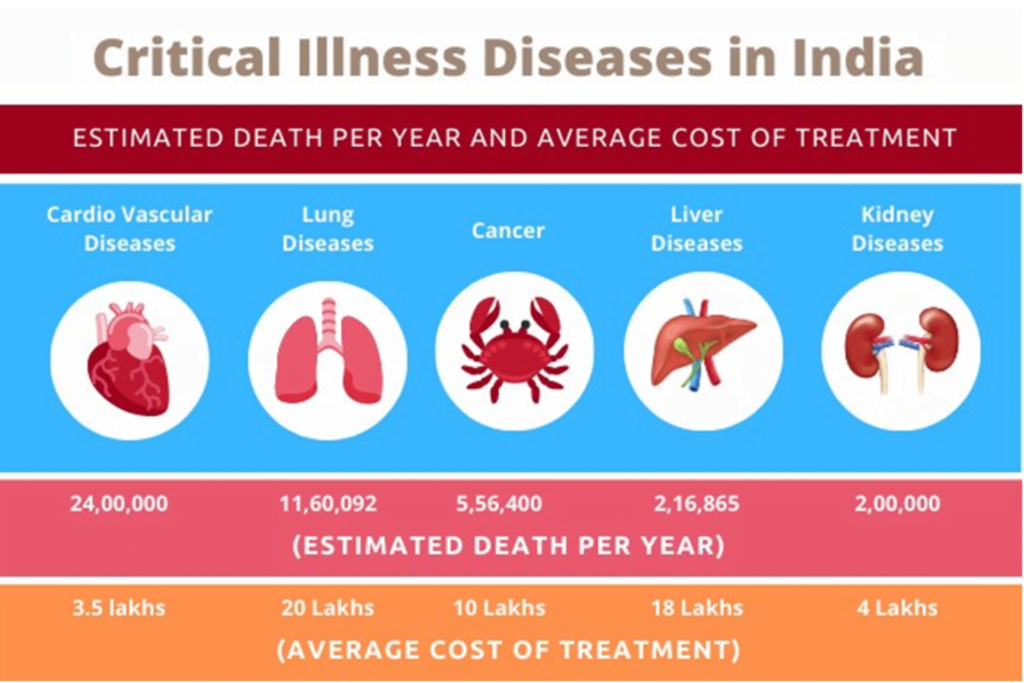

Critical Illness Rider-CIR

Critical Illness Rider-Chart

Premium Chart

First Year Premium

Subsequent Year Premiums

Mode

Basic Premium

GST @ 0.0%

Total Premium

Yearly

104860

0

104860

Half Yearly

52970

0

52970

Quarterly

26755

0

26755

Monthly

8918

0

8918

Mode

Basic Premium

GST @ 0.0%

Total Premium

Yearly

104860

0

104860

Half Yearly

52970

0

52970

Quarterly

26755

0

26755

Monthly

8918

0

8918

Benefit and Coverage Tablert

Conclusion

Here we discuss the details the LIC New Endowment Plan (Plan No : 914) . LIC New Endowment Plan is a good plan for investor to invest their money in LIC.

Pingback: LIC Jeevan Labh 936 Premium - Features, Benefits & Plans Details - LICMDRT

Buying an endowment plan is beneficial for those individuals who have a regular flow of income and might need a significant amount of money after a certain period of time.

Pingback: LIC Dhan Vriddhi Policy : Ish Laxmi Puja Main Dhan Biddhi Mantra, - LICMDRT

Pingback: LIC New Jeevan Shanti Plan 858 Details and Benefits - LICMDRT