LIC Dhan Vriddhi Policy, a non-linked, non-participating individual savings and life insurance plan offered by LIC (UIN: 512N362V01)

The Dhan Vriddhi from LIC is an Individual, Savings, Non-Participating, Non-Linked a life insurance policy that combines savings with protection.

This plan offers the family financial help in the event of unfavorable death of the life guaranteed for the duration of the insurance. Furthermore, it offers assurance.

lump sum payment for the guaranteed surviving life on the maturity date.

This plan can be bought offline via an agent or other middlemen.

including Common Public and Point of Sales Persons-Life Insurance (POSP-LI)

Service Centers (CPSC-SPV) in addition to directly online via the www.India’s Licence.

1. larger Guaranteed Additions for plans with larger Basic Sum Assured;

2. Single Premium Plan;

3. Choices for the Policy Term and Death Cover;

4. Guaranteed Additions during the Policy Term

5. Option to select riders,

6. such as LIC’s Accidental Death & Disability Benefit Rider and LIC’s New Term Assurance Rider;

7. Lumpsum Benefit on Death or Maturity;

8. Option to Take Death Benefit in Instalment and Settlement Option on Maturity;

9. Policy Loan available

2. LIC Dhan Vriddhi Policy Qualifications and Additional Limitations:

i. Policy Duration: 10, 15, and 18 Years

ii. The insurance term’s minimum age of entry is 90 days (finished). The policy duration is 18 years, 3 years (finished). 15 years, 8 years (finished) for a 10-year policy period

iii. 60 years old is the maximum age at entry option 1 (nearer birthday)

Option 2: 40 years (closer to birthday) for a 10-year policy term

35 years (closer to birthdate) for 15 years of policy term; 32 years (closer to birthday) for 18 years of policy term

iv. The 18-year-old minimum age of maturity (fulfilled)

v. The Highest Age of Maturity First choice: 78 years old (closer birthday)

Choice 2: Fifty years (closer to birthday)

vi. Payment Method for Single Premium

vii. No Limit on the Maximum Basic Sum Assured; viii. Minimum Basic Sum Assured of Rs-1,25,000/-

Basic Sum Assured will be expressed in multiples of less than Rs5,000.

LIC Dhan Vriddhi Policy Date of Risk Commencement:

If the life assured’s age at admission is less than eight years, the risk will start two years from the date of the policy’s inception, or from the policy anniversary that falls on or as soon as the individual turns eight years old, whichever comes first. Because Those who are eight years of age or older upon arrival will be at immediate risk of date of risk acceptance, or the date the policy was issued.

LIC Dhan Vriddhi Policy Date of Plan Vesting:

If the policy is issued on the life of a minor, it will automatically vest in the life assured on the policy anniversary that falls on or just after the life assured turns eighteen. At that point, the policy will be deemed to be a contract between the Corporation and the life insured.

3. LIC Dhan Vriddhi Policy Benefits:

Under an active policy, the following benefits are payable:

A. LIC Dhan Vriddhi Policy Death Benefit:

“Sum Assured on Death” plus accrued Guaranteed Additions will be paid out upon the death of the life assured during the policy term, following the date of risk initiation but prior to the date of maturity. The following options will determine the policyholder’s “Sum Assured on Death”:

Option 1: For the selected Basic Sum Assured, 1.25 times the Tabular Premium

Option 2: For the selected Basic Sum Assured, ten times the Tabular Premium

Where the Tabular Premium is determined by the policy term, the option selected, and the age of life insurance enrolment, but before deducting any rebates. Taxes, additional premiums, and any applicable rider premiums are not included.

Nevertheless, in the event that a minor life insured, whose age at entrance is less than eight years, dies prior to the start of the risk (as mentioned in Paragraph 2 above), the Death Benefit that becomes due is a refund of the premium(s) paid, minus taxes, any additional premiums, and any rider premiums that may have been paid, without interest.

The alternatives should be carefully selected based on each person’s unique needs, as the plan’s premium and benefits will vary according on the option selected and cannot be changed afterwards.

B. LIC Dhan Vriddhi Policy Maturity Benefit:

“Basic Sum Assured” plus accrued Guaranteed Additions are awarded to Life Assureds who survive the designated Date of Maturity.

C. Guaranteed Additions:

Depending on the option selected, the basic sum assured, and the length of the policy, the Guaranteed Additions will start to accrue at the end of each policy year and continue throughout the policy term.

4. LIC Dhan Vriddhi Policy Available Options:

I. Benefits for Riders:

The next two riders are optional and can be added for a fee.

premium only at launch:

A. LIC’s Rider for Accidental Death and Disability Benefits (UIN: 512B209V02)

This rider’s benefit coverage will be available for use for the duration of the policy.

Before to the insurance anniversary, the closer the life’s birthday 70 years, whichever comes first, is guaranteed. In the event that this rider is selected, The Accident Benefit Sum Assured will be paid in the event of an accidental death.

lump amount. In the event that an accident causes unintentional permanent handicap

(between 180 and 240 days following the accident date), an amount equivalent to the Accident

The Benefit Sum Assured will be disbursed over the course of equal monthly instalments ten years.

The premium paid under this rider cannot be more than 100% of the Base plan’s premium. The Base plan’s Sum Assured on Death cannot be greater than the Accidental Benefit Sum Assured.

A. The New Term Assurance Rider from LIC (UIN: 512B210V01)

Benefit coverage under this rider will be available for use either during the policy term or, if sooner, before the policy anniversary on which the life insured’s age-nearest birthday is 75 years old. If this rider is selected, upon the death of the Life Assured within the rider period, a sum equal to the period Assurance Rider Sum Assured will be paid.

The Rider Sum Assured cannot exceed the Base plan’s Sum Assured on Death, and the premium under LIC’s New Term Assurance Rider cannot surpass 30% of Base plan premiums.

Refer to the Rider Brochure or get in touch with the LIC branch office closest to you for more information on the aforementioned Riders, including eligibility requirements.

In the event that insurance are purchased through POSP-LI/CPSC-SPV, no rider will be available.

II. Maturity Benefit Settlement Option:

Under the Settlement Option, recipients may choose to receive their Maturity Benefit in five years’ worth of installments rather than all at once. This option may be used for the whole or partial maturity proceeds payable under the policy by the Policyholder while the Life Assured is still a minor or by the Life Assured who is at least eighteen years old. The Net Claim Amount, which is the amount selected by the Policyholder/Life Assured, may be expressed as a percentage of the entire amount of claim profits payable or as an absolute sum.

III. Option to Accept Death Benefit in Instalments:

Under this option, you may choose to receive the policy’s lump sum payment as an installment over the course of five years rather than all at once. Policyholders may exercise this option at any time while the life insured is still a minor or if the life insured is 18 years of age or older, for all or a portion of the death benefits payable under the policy. The Net Claim Amount, which is the amount selected by the Policyholder/Life Assured, may be expressed as a percentage of the entire amount of claim profits payable or as an absolute sum.Under this option, you may choose to receive the policy’s lump sum payment as an installment over the course of five years rather than all at once. Policyholders may exercise this option at any time while the life insured is still a minor or if the life insured is 18 years of age or older, for all or a portion of the death benefits payable under the policy. The Net Claim Amount, which is the amount selected by the Policyholder/Life Assured, may be expressed as a percentage of the entire amount of claim profits payable or as an absolute sum.

5. PLAN ACQUIRED VIA CPSC-SPV & POSP-LI:

Purchases of this plan are made possible by POSP-LI and CPSC-SPV. But in certain situations, the requirements for eligibility and other terms and conditions will follow the guidelines, circulars, and regulations, etc., that the IRDAI has issued and that apply to POSP-LI and POS Plans. The following limitations are currently in effect for proposals funded by CPSC-SPV and POSP-LI:

Option 2 cannot be purchased via the POSP-LI/CPSC-SPV channel.

• 65 years old (age nearest birthday) minus the policy term is the maximum age upon entry.

• 65 is the maximum age at maturity (age nearer birthday)

• Maximum Amount Guaranteed (per Life): around 25 lakhs.

If the Dhan Vriddhi plan from LIC is acquired through POSP-LI or CPSC-SPV, it is classified as a Non-Linked, Non-Participating, Endowment category of POS-Life products. If purchased through the POSP-LI and CPSC-SPV channels (inclusive), the maximum permissible Sum Assured on Death to each individual for all policies under all plans in this category of Non-Linked, Non-Participating, Endowment products shall be about 25 lakhs.

Nonetheless, each person’s maximum permitted Sum Assured on Death shall be determined based on the non-medical limitations under this plan and in compliance with the Corporation’s underwriting policy.

• In the event that insurance are purchased through POP-LI/CPSC-SPV, no rider will be provided.

• If POSP-LI & CPSC-SPV commence the sale, the Key Features Document (KFD) cum Proposal Form applicable for LIC’s Dhan Viddhi will be employed.

6. LIC Dhan Vriddhi Policy SURRENDER:

The policyholder may give up the policy at any point while it is in effect. The Corporation will pay the Surrender Value upon policy surrender, which is the greater of the Guaranteed Surrender Value and the Special Surrender Value.

The policy’s guaranteed surrender value (GSV) will be paid as follows:

• For the first three policy years, 75% of the single premium will be paid.

• Afterwards: 90% of the Individual Premium Taxes, additional premiums, and any applicable rider premiums are not included in the single premium mentioned above.

Furthermore, the surrender value of the accrued Guaranteed Additions, which is the accrued Guaranteed Additions multiplied by the applicable GSV factor, will also be required to be paid.

7. LIC Dhan Vriddhi Policy POLICY LOAN:

Subject to the terms and conditions that the Corporation may from time to time specify, loan may be taken out under this plan at any point during the policy term following three months from the completion of the policy (i.e., three months from the date of policy issuance).

8. Taxes:

Any mandatory taxes that the Indian government or any constitutional tax authority imposes on these insurance policies will be calculated in accordance with current tax laws and rates. The policyholder is responsible for paying all relevant taxes at the current rates on the premium(s) (for the Base Policy and any Rider(s), if any), including any additional premiums that may be required and collected separately on top of the premium(s) that the policyholder is required to pay. The amount of taxes paid will not be taken into account when determining the benefits that the plan pays out.

Please speak with your tax advisor about the benefits of income taxation and how it may affect the premiums you pay and the benefits you receive under this plan.

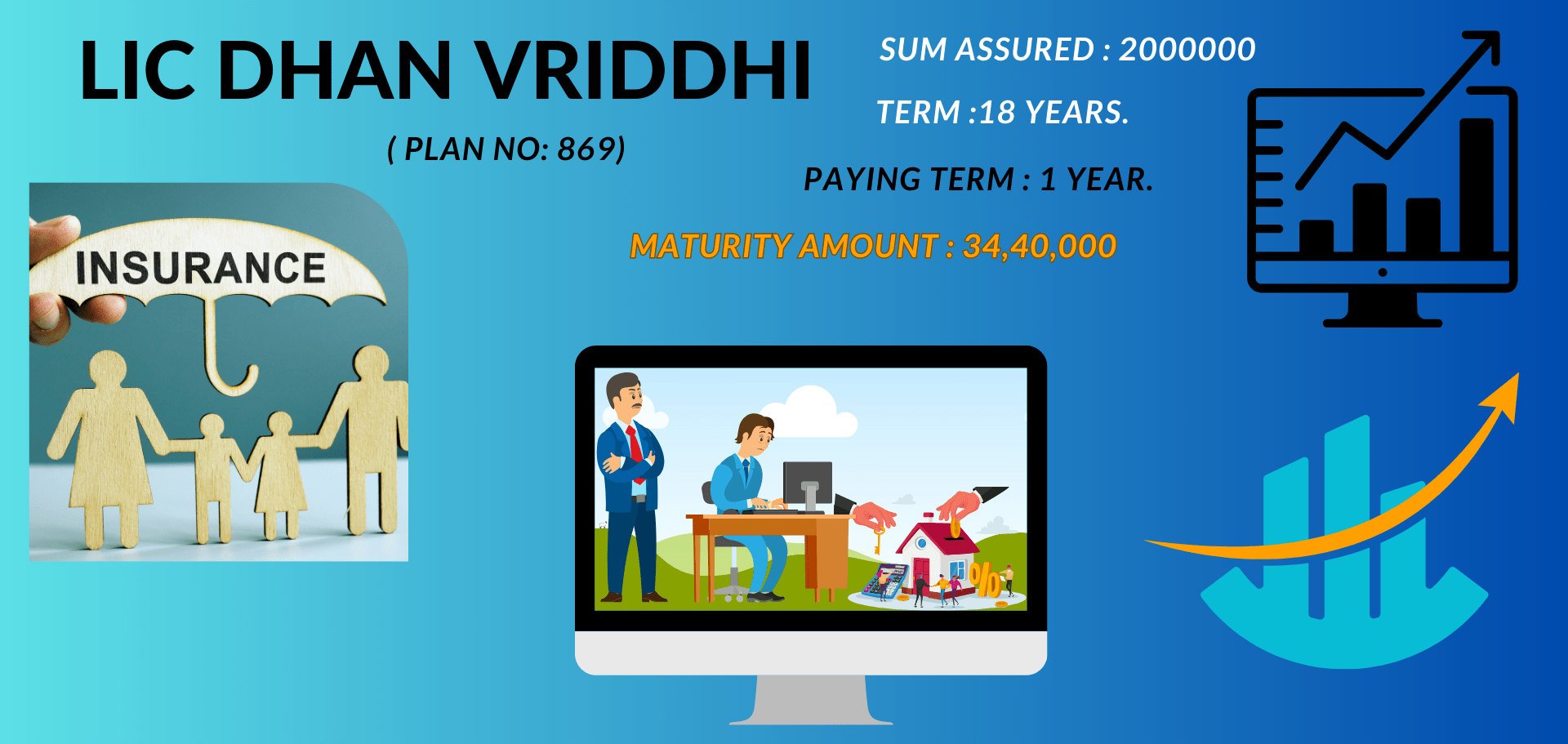

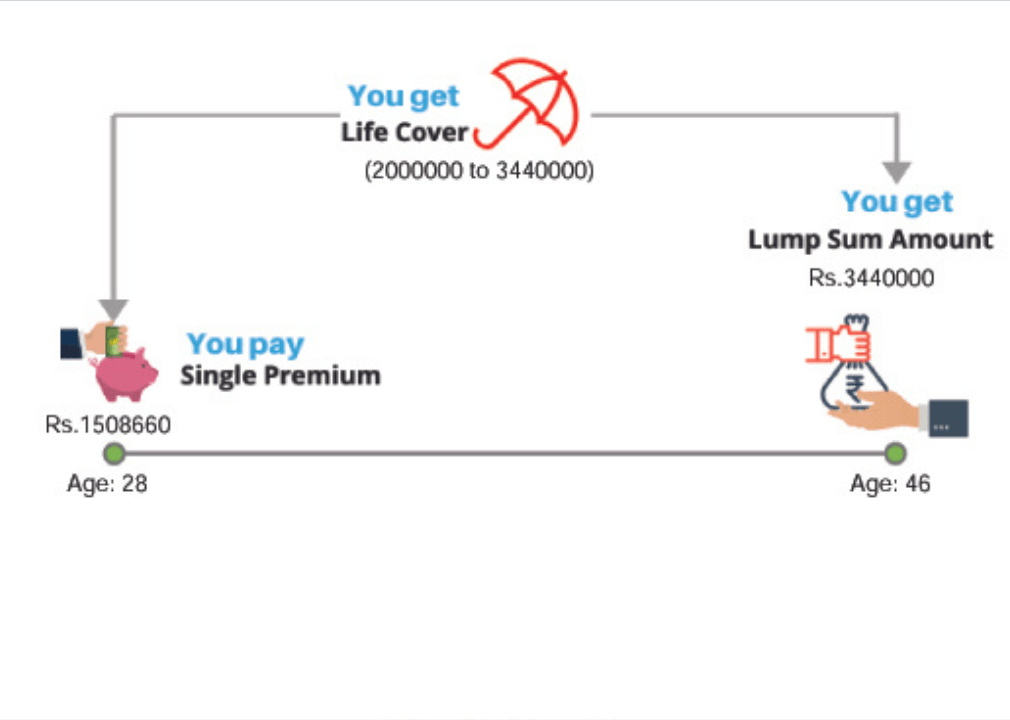

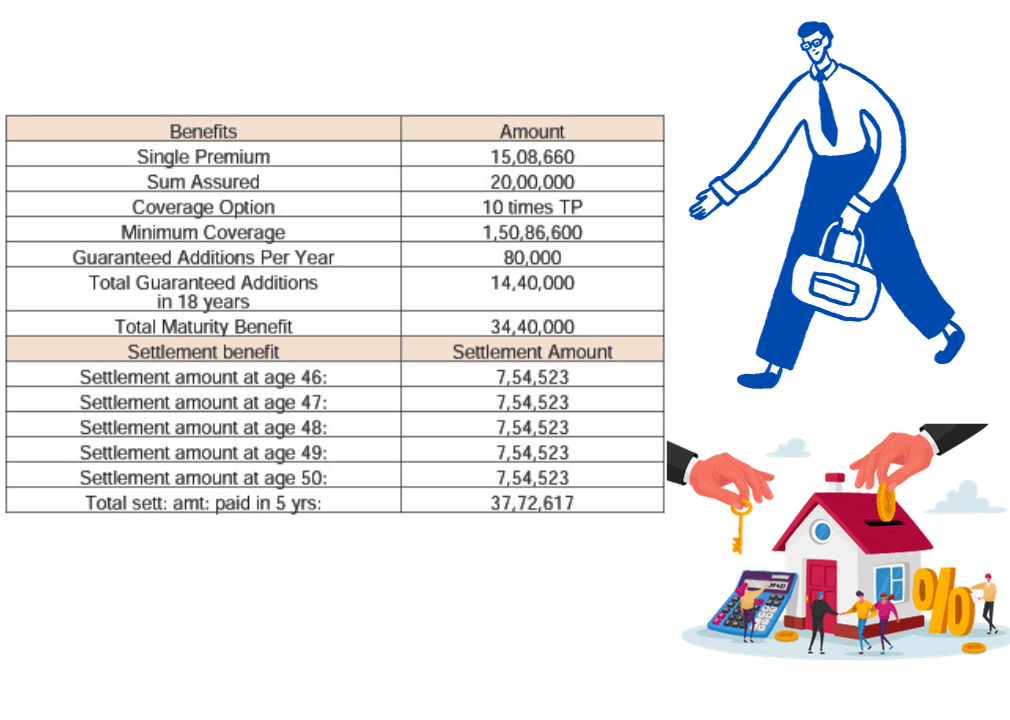

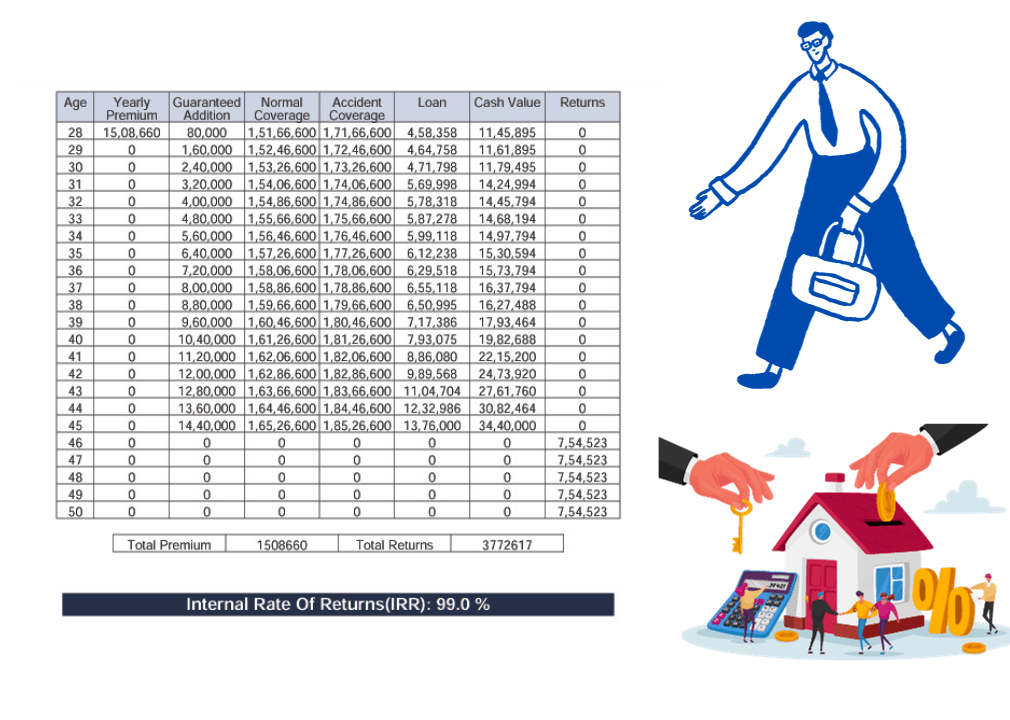

Here we discuss the plan LIC Dhan Vriddhi Plan (Plan No : 869) Mr Nitin jain is a Client, his Age is – 28 years, Sum Assured : 2000000, Term : 18 years, Premium payment : 1 years. See this plane in below.

Dhan Vriddhi Plan (Plan No : 869)

Mr Nitin jain

Age - 28

Sum Assured : 2000000

Term : 18 years.

Premium payment : one year.

Benefit Pattern Illustration

Maturity Benefit

Benefit and Coverage Table

Conclusion

Here we discuss the details the LIC Dhan Vriddhi Plan (Plan No : 869) LIC Dhan Vriddhi Plan is a good plan for investor to invest their money in LIC.

I loved you better than you would ever be able to express here. The picture is beautiful, and your wording is elegant; nonetheless, you read it in a short amount of time. I believe that you ought to give it another shot in the near future. If you make sure that this trek is safe, I will most likely try to do that again and again.